60+ how many points does a mortgage inquiry affect credit score

Borrowers saw an average credit score drop of 204 points after getting a mortgage. For most people one additional credit inquiry will take less than five points off their FICO Scores.

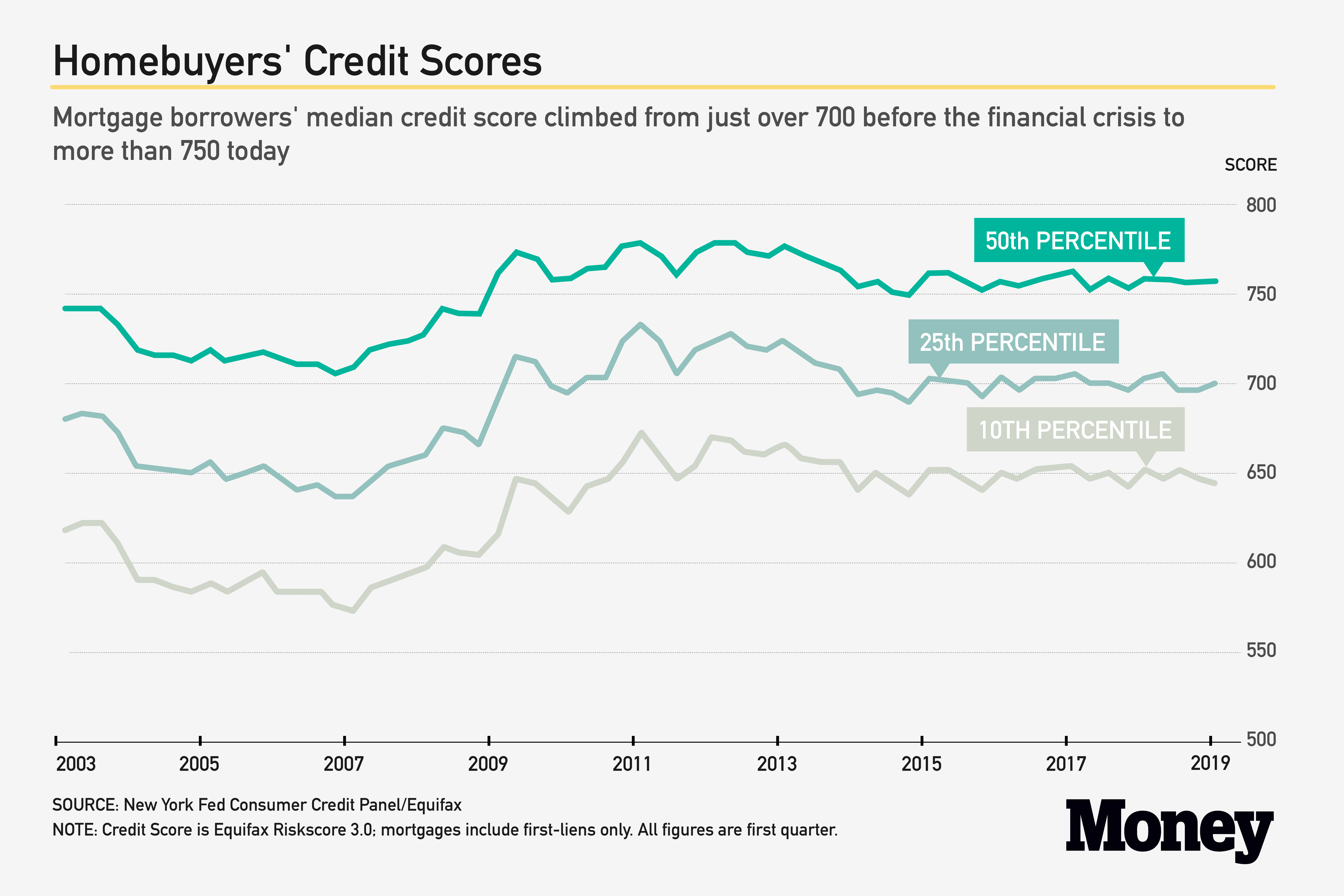

The Average Credit Score For Approved Mortgages Is Declining

Web Within a 45-day window multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry.

. Web Payment history is always the most important factor in credit scoring. Web Seeking too much credit in a short period then drags down your credit score. Compare Rates Get Your Quote Online Now.

Ad Americas 1 Online Lender. For perspective the full range for FICO Scores is 300-850. Web A mortgage adds to your credit history Nothing affects credit score more than your payment history.

Web In general credit inquiries have a small impact on your FICO Scores. Ad Access to all 3 Credit Scores now is more important than ever. We fill in the gaps that other credit score providers simply dont.

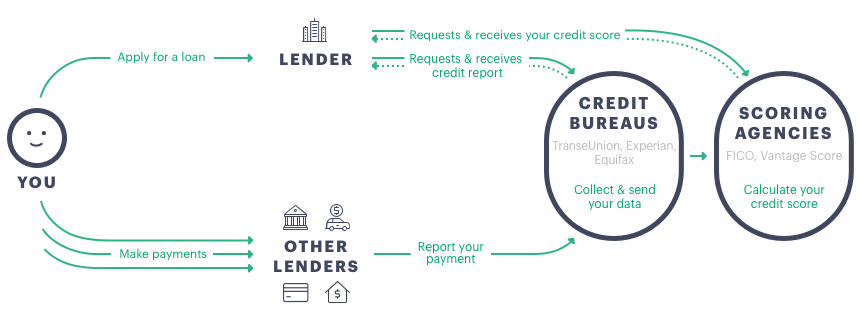

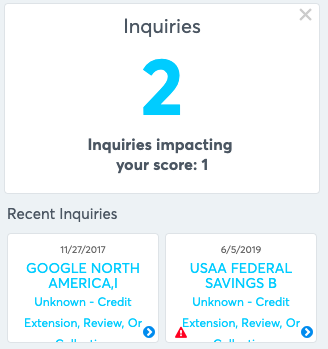

Web A study by LendingTree found that US. Web There are two types of credit score inquiries lenders and others like yourself or your landlord can make on your credit score. This is because other creditors realize.

Web If youre shopping for a new auto or mortgage loan or a new utility provider the multiple inquiries are generally counted as one inquiry for a given period of time. A lower credit score typically means a higher interest rate and a harder time. Web Credit scoring models take mortgage rate-shopping into account and group multiple inquiries together as one if these inquiries all take place within a 45-day period.

Web In many cases a hard credit inquiry will only drop your score by about five points and soft credit inquiries wont affect your score at all. Web For most people one additional credit inquiry will take less than five points off their FICO Scores. Web Depending on how much information you have on your credit report an additional inquiry might not affect your credit score at all.

On the other hand if you. Mortgages typically require 15 to 30 years of payments which. Inquiries may have a small impact but they are the least important factor in credit scores.

It took an average of 165 days after. Web Lets see how a 100-point difference in credit scores affects one womans mortgage payment. While theres no magic number as to how many mortgage lenders you should get quotes from the CFPB suggests contacting at least.

This number can be even lower than five points. Web Typically when someone does a hard inquiry on your credit your credit score will drop by five to 10 points. For example suppose a borrower looking to buy a home worth.

A hard inquiry and a soft inquiry The.

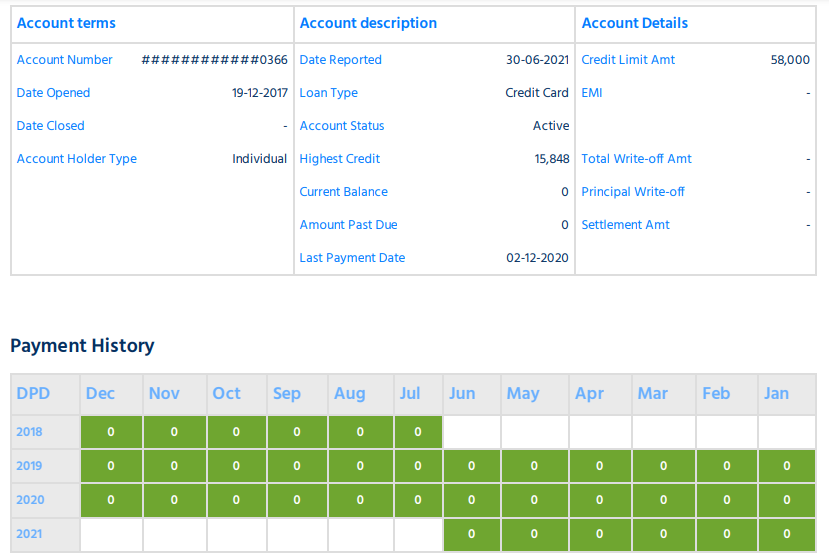

What Is Days Past Due Dpd In Cibil Report Cibil Dpd Format

Pdf Mortgage Rates Household Balance Sheets And The Real Economy

How Many Points Does Your Credit Drop With A Hard Inquiry Quora

The Complete Guide To Understanding And Improving Your Credit Score Upgrade

How Many Points Does A Hard Inquiry Take Away From Your Credit Score The Oasis Firm Credit Repair Services And Tax Prep

How Hard Inquiries Affect Your Credit Score Wealthfit

How To Check Your Credit Score Rating Propertynest

This Is The Credit Score You Need For A Mortgage Money

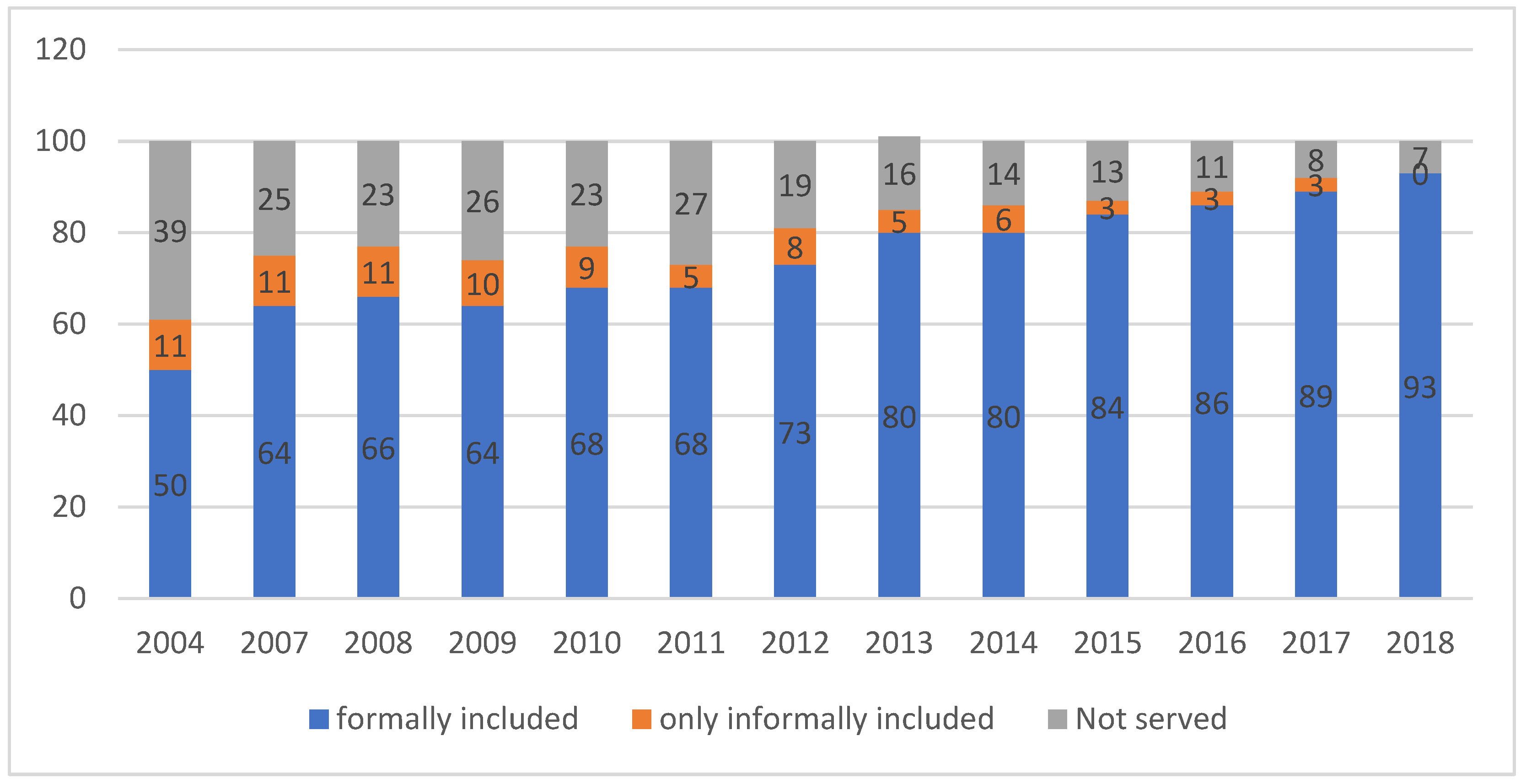

Jrfm Free Full Text Financial Inclusion In Rural South Africa A Qualitative Approach

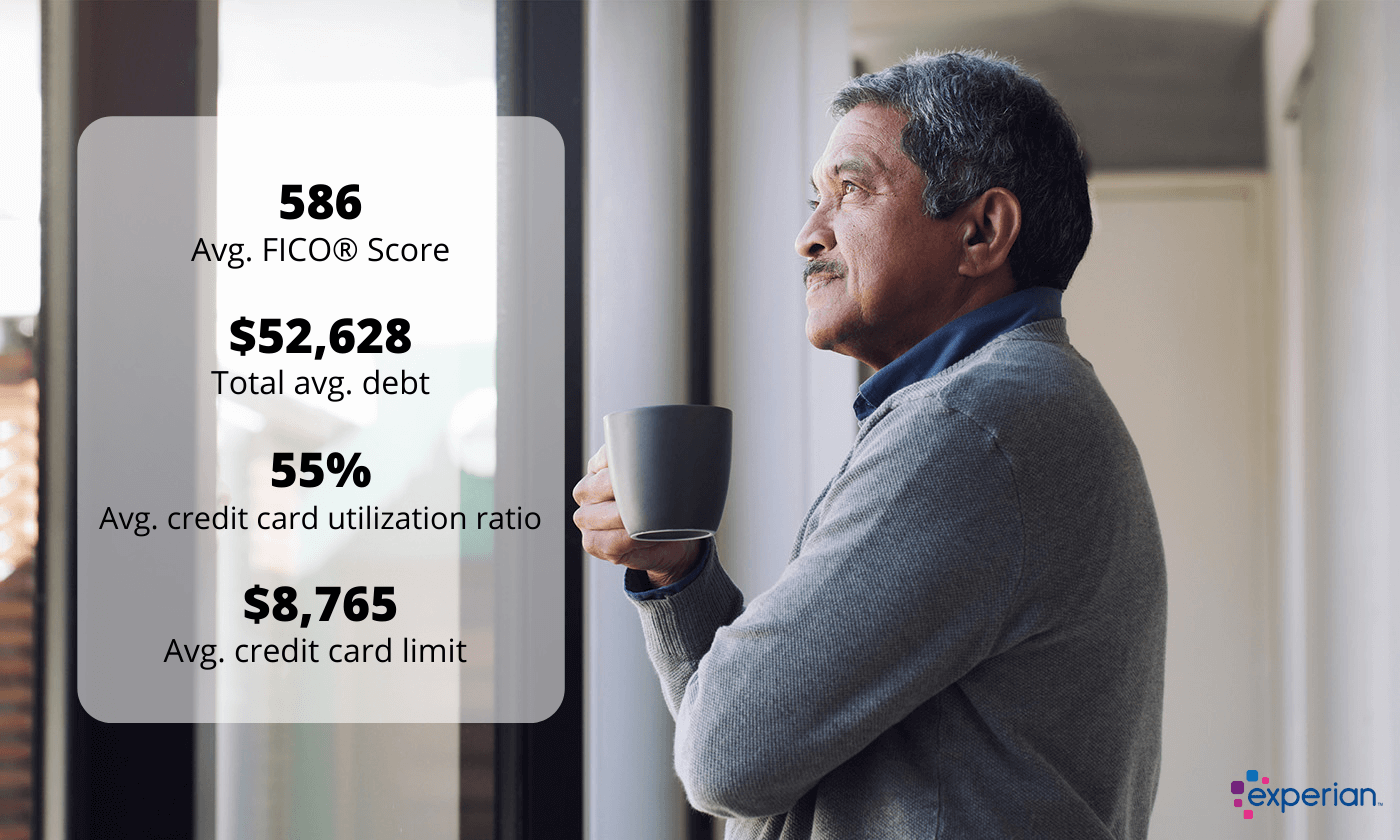

Fewer Subprime Consumers Across U S In 2021 Experian

What Is The Average Credit Score Marcus By Goldman Sachs

Do Multiple Loan Inquiries Affect Your Credit Score Experian

How Many Points Does A Hard Inquiry Affect My Credit Score Nav

How Many Points Does A Mortgage Inquiry Affect Your Credit Score Go Clean Credit

Credit Card Utilisation Impact On Credit Score Mymoneysouq Financial Blog

How Many Points Does A Hard Inquiry Affect A Credit Score

The Different Types Of Credit Scores Over 60 To Choose From